The US Bailout is still a Rumor; they fryin chicken and buyin lot-trees

September26

WHO SAYS THE FDIC WON’T RUN OUT OF MONEY AND BE UNABLE TO PAY THESE INVESTORS OFF

IT ONLY HAS 42 Billion - and Washington Mutual cost 700 Million; the Bail Out is estimated to cost 700 BILLION. So Tell Me Where is that going to Leave US ? BANKRUPT or BANKRUPT ?

The US Bailout is still a Rumor; they fryin chicken and buyin lot-trees Yeah I Said It.

the senate and president are sitting up in washington not doing a damn thang, about this financial spaghetti pie; they tryin to serve up as our economy, today. sounds more like Fishy Friday to me.. what y’all think about this ?They Argue, then They Argue somemore.. then they stop arguing and stop talking and start blaming each other.

WHAT ARE THEY DOING ????? EVEN WORSE WHY ARE WE LETTING THEM DO IT ????

Isn’t this what the Posse’ Comatatus is all about ? Somebody call TBoone and tell him to get in his Gas Caddie and Roll Up On Em, Rite NOW.

This Washington Mutual Failure was no sacrificial lamb. this was the first of many which will be led to the slaughter as we watch our savings run red in the streets. It’s Time For A Change Folks.

~RE

Q&A: US $700bn bail-out plan

(bbcnews) The crisis in financial markets has led to the comprehensive bail-out plan |

The plan, which has so far failed to get Congressional approval, is aimed at stabilising financial markets.

Initially Democrat and Republican legislators appeared to have struck a deal. However, the agreement unravelled when a group of Republican legislators objected to the plan on principle.

They are concerned that the package has not been thought through properly, and could cost the US taxpayer too much.

Why is the US government acting now?

The continued turmoil in US financial markets, which has triggered volatility in global share markets, has led US Treasury Secretary Henry Paulson to seek a comprehensive solution to the crisis.

The move comes after the US Treasury pledged $200bn to sort out financial problems at giant government-sponsored mortgage lenders Fannie Mae and Freddie Mac, lent $85bn to shore up insurance giant American International Group, and guaranteed $29bn to support the bail-out of investment house Bear Stearns in March.

The root of the market collapse is the fear that banks and other institutions still hold too many “toxic assets”, which are based on mortgages that are now going bad.

One in 10 US mortgage holders is now 90 days or more in arrears, and one in four families with a sub-prime mortgage is in serious arrears.

What is the Treasury planning to do?

The Treasury is asking for unlimited authority to purchase these “troubled assets” in order to remove the “illiquid mortgage assets” that are clogging the financial markets.

It wants wide authority to purchase any “residential and commercial mortgage-related assets, which may include mortgage-backed securities and whole loans”.

It also wants authority to purchase “any other assets as deemed necessary to stabilize the financial system” after consultation with the chairman of the Federal Reserve.

And it wants complete discretion to determine the timing and scale of any purchase, only subject to the total spending cap of $700bn.

The bail-out plan is scheduled to last two years, after which the authority to buy up assets, but not to sell them, would expire.

Will the plan be accepted?

So far it has faced sharp Congressional criticism and talks to achieve a break-through agreement have broken down. As yet the White House has failed to sway Congress, particularly some Republicans.

In intense discussions, the US Treasury Secretary Henry Paulson reportedly went down on one knee, begging Nancy Pelosi, the leader of the Democrats in the House of Representatives, to help push through the bail-out package.

Mr Paulson has warned that delaying the package would “threaten all parts of our economy”.

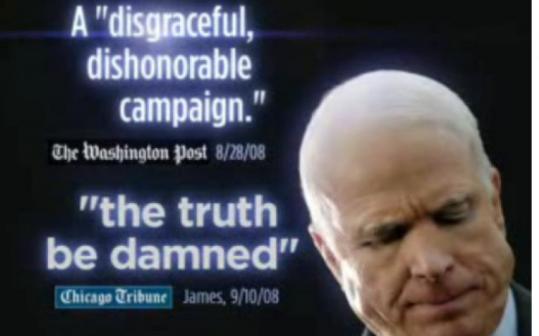

Both presidential candidates Barack Obama and John McCain want independent oversight of the plan and assurances that the salaries of the bosses at the benefiting banks would be restricted.

Some Republicans argue that a less financially risky alternative for US taxpayers would be for the government to provide insurance to companies who buy these assets, rather than buy them itself.

How will the US government finance the purchase?

The US government will borrow the money from world financial markets. The proposed legislation gives the Treasury the authority to issue an additional $700bn worth of Treasury securities.

The hope is that eventually the Treasury can sell the distressed assets back into financial markets once the housing market stabilises, perhaps making a profit on the sale.

Others are concerned that issuing more government debt, and virtually doubling the size of the budget deficit, could be inflationary.

The sale could also make the US more dependent on foreign banks, who may be the biggest purchasers of Treasury securities.

Who will carry out the purchases and manage the assets?

The US government intends to appoint agents to manage the purchases, which are likely to be other Wall Street firms.

It says that the assets will be managed privately but that the Treasury “will have full discretion over the management of assets” which it could “sell at its discretion or may hold assets to maturity”.

And any cash received by liquidating the assets “will be returned to the Treasury’s general fund for the benefit of US taxpayers”.

Will the distressed assets be easily priced?

No. This one of the hardest challenges for the Treasury.

It has provided no clear guidance, other than to say that the price of the assets will be determined “by market mechanisms where possible, such as reverse auctions”.

However, since no real market exists for many of these complex financial instruments, judging their true value will be extremely difficult.

Some mortgage-backed securities were recently sold by Merrill Lynch for 22% of their book value, while some regional banks have their assets valued at 50-75% of book value.

It the government bids low for these assets, it will force some banks to sharply revalue their assets, thus increasing the credit squeeze.

However, if they pay too much, they could be accused of giving a windfall profit to Wall Street firms that speculated on a bail-out.

What banks are eligible to take part?

The Treasury initially said that only US banks could sell distressed assets to the government, but after lobbying by foreign banks it now says that “participating financial institutions must have significant operations in the US”, which would include many of the larger investment banks.

However, the Treasury Secretary would have the discretion to add other institutions if “broader eligibility is necessary to effectively stabilize financial markets”.

Some banking organisations, notably in Germany, believe that all banks which hold US mortgage assets should be allowed to participate in the rescue deal.

The fear was that HBOS might face a run on its deposits like Northern Rock |

The past month has been one of unprecedented turmoil in the financial markets.

Each day has brought an extraordinary development that would have seemed astonishing just the day before.

In the largest bank failure yet in the United States, Washington Mutual, the giant mortgage lender which had assets valued at $307bn (£167bn), was closed down by regulators. It was then sold to rival JP Morgan Chase for $1.9bn.

The US investment bank Lehman Brothers was allowed to go bust while one of the world’s largest insurers AIG was bailed out.

In the UK, a takeover of the biggest mortgage lender HBOS was approved by the government to forestall a run on it by customers.

To try and put an end to the turmoil, the US authorities have been seeking approval from Congress for a $700bn bail-out plan to relieve the US banking system of its mortgage debts and limits were put on so-called “short-selling” of shares, both in the UK and the USA.

BBC News looks at whether the average person is really in a different position from just a couple of weeks ago.

Is my bank safe?

This is what the UK (and US) government and financial authorities have been worried about - that banks exposed to too many defaulting mortgages might collapse.

With the very fear of this causing the financial system to seize up again, the worry was that this prospect might become a self-fulfilling prophecy, with a domino effect undermining the banking system here and abroad.

Hence the rush to ensure that HBOS was taken over, despite the bank and the authorities saying until they were blue in the face that it had lots of money.

What about my savings?

As long as you have less than £35,000 saved with any one UK financial institution, you will not lose if the worst happens and your bank goes under.

That is because of the protection offered by the Financial Services Compensation Scheme.

However, you might have to wait a while to get your money back.

Unlike in the US, where small banks frequently go bust, there is no mechanism in place yet to effect a swift rescue of a UK bank.

If you have more than £35,000 in any one institution you might consider moving some of it to another one.

Will my mortgage become more expensive?

Most likely yes, if you are looking for a new deal.

The cost to banks of borrowing and lending money between themselves has risen again, driving up the cost to banks of funding and offering new fixed-rate and other mortgage deals.

Libor, or the London Interbank Offered Rate, is the rate at which banks lend money to each other, and the three-month rate has reached its highest level since December, rising well above 6%.

Three major lenders have raised some of their mortgage rates - HSBC, Woolwich and First Direct - and other lenders are reviewing their deals.

The takeover by Lloyds TSB of HBOS will also reduce competition among mortgage lenders, tending to make it easier for the remaining lenders to charge that bit more for their loans - or offer less interest on bank accounts.

So mortgages are likely to be set higher above the Bank of England’s base rate than was the case before.

The Bank of England has said the rate of inflation would soon hit 5%, before falling back. Once it is convinced this is about to happen it may well cut rates to help stimulate the economy and overcome the impending economic recession.

So in due course mortgages should become cheaper; but not just yet.

Will this financial crisis make the economy worse?

Let us assume that no more banks get into trouble and that things stabilise.

Even then, the downturn is likely to be worse than would have been the case just a few weeks ago.

Banks and the money they lend are essential to the normal functioning of the economy.

If they have less money to lend, or do so on much more expensive terms, this will inevitably restrain economic activity, just as if the Bank of England had jacked up its bank rate.

Is my job more precarious than before?

Potentially - and not just for bank employees and others in the financial sector.

In more normal times, the big economic news this month would probably have been the further rise in unemployment.

Let us remember what that story is. Unemployment is now at its highest level for nine years at a rate of 5.5%.

Redundancies have been accelerating and the number of vacancies, and those actually in work, is dropping.

Sadly the trend in unemployment is firmly upwards and will probably continue until the economy starts to pick up again.

Wall Street rescue deal stalemate

(bbcnews)House Speaker Nancy Pelosi on ABC Good Morning America

Talks to agree a huge $700bn (£380bn) bail-out of the US financial industry have ended in a “shouting match”.

After several hours of discussions with President George W Bush, a group of Republican members of Congress blocked the government plan.The proposal would have seen the government buy bad debts from US banks to prevent more of them collapsing.

President Bush is due to make a statement about the negotiations at 0935 in Washington (1435 BST).

Both sides have agreed to resume talks later on Friday. The leader of the Democrats in the House of Representatives, Nancy Pelosi, told ABC News that she “hoped” a bailout plan could be agreed within 24 hours, because “it has to happen”.

Financial markets are gummed up because banks do not know exactly how much bad debt they hold and are therefore reluctant to lend to businesses, consumers and each other.

The fall-out of this credit crunch continues to make a huge impact:

- The United States suffered its largest bank failure yet, when regulators moved in to close down Washington Mutual and then sold it to US rival JP Morgan Chase for $1.9bn

- In a co-ordinated move the European Central Bank, the US Federal Reserve, the Bank of England, Bank of Japan and the Swiss National Bank announced new short-term loans to the banking sector worth tens of billions of dollars

- Banks continued to cut costs, with UK banking giant HSBC saying it would axe 1,100 jobs

- Shares in UK bank Bradford & Bingley fell another 20% to 17 pence before recovering slightly.

On Thursday, Democrat and Republican legislators appeared to have struck a deal.

A group of Democrats and Republicans even made a public statement, with Senator Christopher Dodd, chairman of the Senate Banking Committee, announcing that they had reached “fundamental agreement” on the principles of a bail-out plan.

Justin Webb North America editor |

The intense discussions reportedly saw US Treasury Secretary Henry Paulson literally down on one knee, begging Ms Pelosi to help push through the bail-out package.

However, the agreement unravelled when a group of Republican legislators objected to the principle of the plan.

The talks at the White House, led by Mr Paulson and US President George W Bush, then descended into what one participant described as “a full-throated discussion”.

Officials with the campaign team of Republican presidential candidate John McCain spoke of “a contentious shouting match”.

The Republican critics of the bail-out plan worry about both its cost and how it would involve the government in the financial sector. Instead, they want a government-backed insurance policy for the huge amounts of bad debt built up by US banks.

This proposal, however, was described as “unworkable” both by Democrat politicians and some US government officials.

Doubts over presidential debate

Some Democrats were scathing about the lack of support for the Paulson plan.

FROM THE TODAY PROGRAMME |

Key finance firms ‘probed by FBI’

(bbcnews) The US government has stepped in to rescue some struggling institutions |

The FBI has begun an investigation into four major US financial institutions caught up in the current financial crisis, US media say.

Investigators are reportedly examining possible fraud by mortgage giants Fannie Mae and Freddie Mac, the failed bank Lehman Brothers and insurer AIG.

Top managers at those firms are also being investigated, the reports say.

In the past year, as the US housing market slumped, the FBI began a broad inquiry across the financial sector.

It was prompted by concerns over the way high-risk, “sub-prime” mortgages were being sold.

The FBI has been looking at lenders who sold home loans to buyers on low or unpredictable incomes and also the investment banks that packaged these loans and sold them on.

Bankruptcy

Investigations into the four companies were at an early stage, officials told the Associated Press news agency.

ABC News, citing unidentified sources, said the probes were assessing whether company officials systematically misled investors about the financial strength of their institutions.

The slump in the US housing market has resulted in billions of dollars of losses for these banks and turmoil in world credit markets.

Last week FBI director Robert Mueller said more than 20 large financial firms were already under investigation.

Bail-out

Freddie Mac, Fannie Mae and AIG are all being bailed out by the US government.

And the government recently announced a $700bn bail-out plan that would enable banks to offload their bad debt.

But both Democrat and Republican politicians have voiced concerns that taxpayers could be paying a high price for the risks initially undertaken by banks.

Democrats want help for individuals who stand to lose their homes, as well as limits on pay for the bosses at the firms in question.

If you enjoyed this post, make sure you subscribe to my RSS feed!UK Banks Get a Touch Up after Weak Peroid; Who’s Next, Not US

September26

Take a Look at these Charts and Get Prepared because the economic picture is exactly - HORRIBLE.

I’m sure most of us are not prepared for this type of bad news on a friday - which seems very much like that friday in 1929 when the Depression Began; for us it began years ago when we started preaching against this “Economic Bush Wack-ism”. enough is Enough. do not think that this is the end, because these facts and figures tell a whole different dim story.

It might be time to literally show the banks our feelings when we ALL Grab Our savings and put it in our mattress where it won’t loose any value while you’re sleeping on it.

~RE

The downturn in facts and figures

FALLING GROWTH FORECASTS

Projections for economic growth have been getting more pessimistic as the true nature of the credit crunch becomes clear. To see IMF projections since 2006 select one of these options.

.rads{margin:0 2px 0 0; padding-left:0;} .one{ margin:0 0 0 0;} .two{ margin:0 0 0 0;} .three{margin:0 0 0 0px;} p.f_m{width:416px; margin-bottom:3px;} label.kvote{font-size:11px;}  RISING COMMODITY PRICES  GLOBAL BANK LOSSES Banks and other financial institutions could lose $1 trillion from the credit crisis as mortgage-backed assets have lost most of their value. FROZEN CREDIT MARKETS  COLLAPSING HOUSING MARKETS Underlying the financial market wobbles is a real decline in US house prices nationwide for the first time since the 1930s. JITTERY STOCK MARKETS Stock markets around the world - from Shanghai to London - have plunged, while in the US the Dow Jones industrial average has made big losses this year. |

Bank giant HSBC axes 1,100 jobs

HSBC hopes the cuts will allow it to weather the storm on financial markets |

Banking giant HSBC is to axe 1,100 jobs worldwide, blaming the current financial turmoil for the decision.

About half of the cuts, which will affect back room jobs at its global banking and markets operation, will take place in the UK.

HSBC employs about 335,000 people around the world.

Last month, HSBC said half year profits fell 28% to $10.2bn (£5.2bn), as it was forced to write-off $14bn from bad debts in the US and asset write-downs.

Meanwhile, pre-tax profits fell 35% to $2.1bn during the same period.

An HSBC spokesman said the firm had opted to reduce its workforce, “because of market conditions and the economic environment, and our cautious outlook for 2009″.

Many of the job-losses will be at the headquarters of HSBC’s investment banking division, which are in London’s Canary Wharf.

Banks around the world have been coming under increased pressure from the credit crisis currently affecting financial markets.

The problems have forced governments to step in and boost money markets as well as bail out a number of companies.

Earlier this year, the UK government had to buy mortgage lender Northern Rock, while in the US lenders Fannie Mae and Freddie Mac have been rescued as well as insurer AIG and investment bank Lehman Brothers filed for bankruptcy.

URL: More cash is injected into banks

It is the latest in a series of co-ordinated central bank cash injections |

Central banks are taking co-ordinated action to lend extra cash to banks.

The Bank of England, US Federal Reserve, European Central Bank and Swiss National Bank will be involved.

The Bank of England will be lending an extra $30bn (£16bn) for a one week period, $10bn overnight and $40bn in three-month loans.

The Bank of England had been holding auctions of three-month loans once a month but will be holding them once a week for at least the next three weeks.

The central banks said that the extra cash was intended to help banks as they approach the end of the financial third quarter next week.

Robert Peston, Business editor, BBC News |

One of the reasons they have been reluctant to lend to each other has been the fear of further bank failures and the news that Washington Mutual has become the biggest US bank to fail will do nothing to help that situation.

Banks will be able to use their mortgage books as security on the loans.

Separately, the Bank of Japan injected cash into the Tokyo money markets on Friday for the eighth trading day in a row.

It injected 1.5 trillion yen ($14bn; £8bn) into the market, although it later removed 300bn yen of that.

Most of us are Stymied on what this whole bailout will do to the economy; but we already know it's not good. from all projections made by competent economists - we are in for a repeat of 1929. and fyi this was an engineered crash meant to overwhelm the upcoming elected officials who will be saddled with the tremendous task of making this figure out of thin air. our economy is in shambles thanks to the shrub.

Most of us are Stymied on what this whole bailout will do to the economy; but we already know it's not good. from all projections made by competent economists - we are in for a repeat of 1929. and fyi this was an engineered crash meant to overwhelm the upcoming elected officials who will be saddled with the tremendous task of making this figure out of thin air. our economy is in shambles thanks to the shrub.